San Diego Home Insurance Things To Know Before You Get This

Wiki Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Program

Importance of Affordable Home Insurance Policy

Protecting inexpensive home insurance is critical for protecting one's residential or commercial property and economic health. Home insurance coverage gives protection versus different dangers such as fire, theft, all-natural calamities, and personal responsibility. By having an extensive insurance coverage plan in location, house owners can feel confident that their most considerable investment is protected in the event of unforeseen circumstances.Economical home insurance not just supplies monetary security yet additionally uses satisfaction (San Diego Home Insurance). In the face of climbing building values and building prices, having an economical insurance plan ensures that home owners can easily rebuild or fix their homes without facing substantial monetary worries

Additionally, inexpensive home insurance policy can additionally cover personal belongings within the home, supplying reimbursement for products damaged or taken. This coverage prolongs past the physical framework of your house, securing the contents that make a residence a home.

Coverage Options and Limits

When it comes to coverage limitations, it's vital to recognize the maximum amount your policy will certainly pay out for every type of insurance coverage. These restrictions can differ depending upon the policy and insurance provider, so it's important to evaluate them carefully to guarantee you have sufficient security for your home and assets. By comprehending the coverage choices and limits of your home insurance plan, you can make informed choices to safeguard your home and loved ones efficiently.

Aspects Affecting Insurance Prices

Several variables dramatically affect the prices of home insurance coverage plans. The location of your home plays a critical duty in figuring out the insurance policy costs. Homes in locations prone to natural catastrophes or with high criminal offense prices usually have greater insurance policy prices due to boosted threats. The age and problem of your home are additionally variables that insurance providers consider. Older homes or properties in inadequate problem may be much more expensive to guarantee as they are extra vulnerable to damage.Moreover, the sort of coverage you pick directly influences the expense of your insurance plan. Choosing extra coverage options such as flooding insurance coverage or quake protection will certainly enhance your costs. Selecting higher insurance coverage limits will result in greater prices. Your deductible amount can likewise influence your insurance expenses. A greater deductible typically suggests lower costs, yet you will certainly need to pay more out of pocket in the occasion of a case.

Additionally, your credit history, declares background, and the insurance provider you select can all affect the price of your home insurance plan. By thinking about these variables, you can make informed decisions to assist handle your insurance policy costs successfully.

Comparing Providers and quotes

Along with contrasting quotes, it is critical to review the track record and monetary security of the insurance policy providers. Search for client evaluations, scores from independent companies, and any kind of background of problems or governing activities. A visit the site dependable insurance coverage supplier need to have an excellent record of promptly refining cases and giving superb client service.

Additionally, consider the particular coverage attributes offered by each company. Some insurance providers might provide fringe benefits such as identity theft protection, devices malfunction coverage, or coverage for high-value items. By very carefully contrasting companies and quotes, you can make a notified decision and select the home insurance policy strategy that best meets your needs.

Tips for Minimizing Home Insurance Policy

After completely comparing quotes and companies to discover the most suitable coverage for your demands and spending plan, it is sensible to explore reliable methods for minimizing home insurance policy. One of one of the most considerable ways to save money on home insurance policy is by bundling your plans. Several insurance coverage firms use discounts if you acquire several policies from them, such as combining your home and automobile insurance. Raising your home's safety additional info actions can likewise cause cost savings. Installing safety and security systems, smoke alarm, deadbolts, or a lawn sprinkler system can reduce the danger of damages or burglary, possibly decreasing your insurance premiums. Additionally, preserving a great credit scores score can favorably affect your home insurance policy prices. Insurers frequently think about credit report when determining premiums, so paying bills on time and managing your debt sensibly can cause lower insurance prices. On a regular basis assessing and upgrading your policy to reflect any kind of adjustments in your home or conditions can guarantee you are not paying for protection you no longer requirement, helping you conserve cash on your home insurance coverage premiums.Final Thought

In final thought, guarding your home and enjoyed ones with economical home insurance coverage is vital. Carrying out pointers for conserving on home insurance policy can likewise assist you protect the needed security for your home without damaging the bank.By deciphering the complexities of home insurance plans and discovering sensible approaches find out here for protecting cost effective protection, you can make sure that your home and liked ones are well-protected.

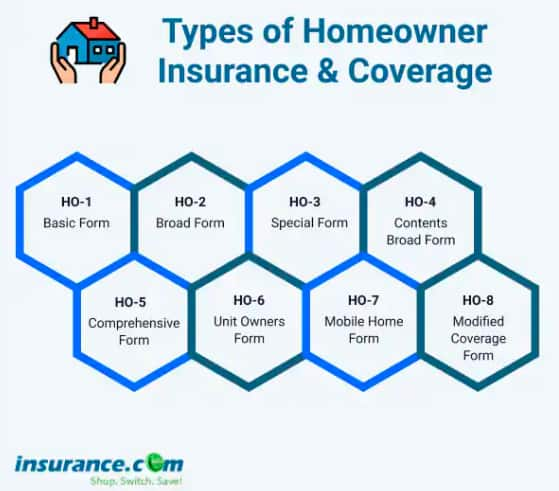

Home insurance coverage policies usually provide several coverage alternatives to shield your home and belongings - San Diego Home Insurance. By understanding the coverage options and limits of your home insurance plan, you can make enlightened choices to protect your home and liked ones effectively

Frequently evaluating and updating your plan to show any adjustments in your home or situations can ensure you are not paying for insurance coverage you no longer requirement, helping you conserve cash on your home insurance coverage premiums.

In verdict, protecting your home and enjoyed ones with budget friendly home insurance policy is vital.

Report this wiki page